Empowering through Education

Our financial literacy and homeownership courses guide you toward financial stability, homeownership, and long-term wealth.

Educationoverview

We offer financial literacy and homeownership courses with a focus on racial justice. Taught by local experts, these courses help you boost your financial knowledge and understand how homeownership can build long-term wealth. After completing the Wealth Building Course, you’ll get ongoing support from a mentor to guide you every step of the way.

First, we help you establish financial stability. You’ll get the tools to assess your readiness to buy a home and learn the key steps to securing financing.

First, we help you establish financial stability. You’ll get the tools to assess your readiness to buy a home and learn the key steps to securing financing.

Next, we guide you through the home buying process. You’ll learn real estate terms, what’s involved in buying and closing on a home, and how to use real estate as a way to grow your wealth.

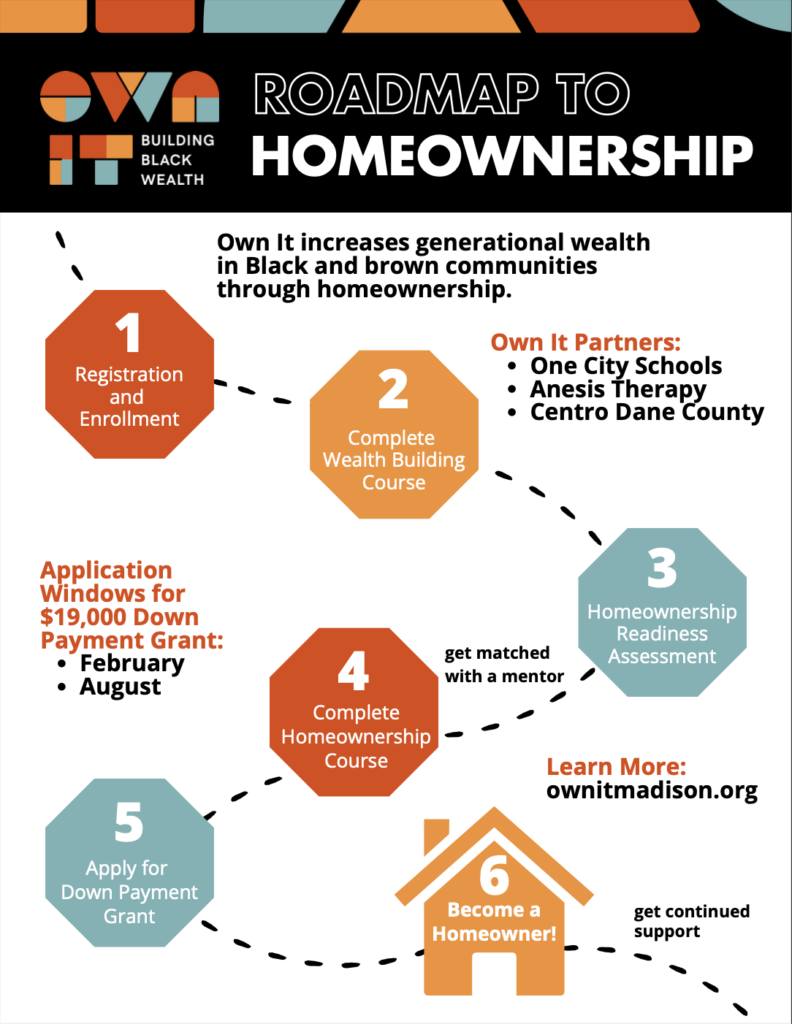

- Registration and enrollment

- Complete the Wealth Building course

- Homeownership readiness assessment

- Complete Homeownership Course

- Apply for a down payment grant

- Become a homeowner!

Roadmap to homeownership (pdf) »

Wealth Building Course

The Wealth Building course is online and self paced. It includes six sessions on topics like budgeting, income vs. wealth, understanding credit, retirement, taxes, and more. Even if homeownership isn’t right for you just yet, you’ll still get valuable tools to help you build wealth and plan for the future. With the right knowledge comes the confidence and power to navigate a system that wasn’t built for Black and brown families — and we’re here to break the mold and create new paths for financial success.

Homeownership Course

The Homeownership course covers everything you need to know about buying a home — from the financing process to picking the right real estate agent, different loan programs, inspections, and using home equity to build wealth. We put a big emphasis on guiding you through the home buying journey with a team of trusted professionals by your side.

You’ll start working with a mentor during the course, and they’ll be with you through the grant application, the home buying process, and even after closing. Mentorship is a key part of our program because we know that while homeownership is a great tool for building wealth, it’s just the beginning. Once you own a home, new challenges and opportunities come up, and having a mentor to lean on is everything.

Down paymentgrants

After completing both courses, families can apply for a grant from the Own It down payment fund, with up to $19,000 available per household. Once you're approved, you’ll have a full year to find the perfect home, make an offer, and close on your new home.

Supportnetwork

We’re here to support you every step of the way. Our goal is to make sure families have the resources they need throughout all stages of home buying and homeownership. With help from course instructors, community experts, and your class cohort, you’ll have a strong support network to lean on as you finance, buy, close on, and take care of your new home.

Ourinstructors

We're so grateful to our instructors for sharing their expertise on personal finance, homeownership, and building wealth through real estate with program participants.